Learn about fractional NFTs in the blockchain industry. Find out what is a fractional NFT and how you can get involved!

NFTs on the blockchain network establish exclusive ownership over a digital asset for its collector. Exclusivity also increases NFT pricing limiting it to big investors. After all, the six-figure floor price of a Bored Ape is beyond the reach of most investors.

Fractional NFTs bring the concept of decentralized digital assets where mid, and small-tier investors can also contribute to growing the NFT market capitalization.

Non-fungible token (NFT) strategists are always exploring economic options so that more investors can enter the space. One such solution is producing fractional NFTs of a costly NFT asset, similar to company shares traded in the stock market.

Small investors can now own a small fraction of a trending yet expensive NFT instead of buying it for an extravagant price. The idea is pacing up, and it’ll likely transform the cryptosphere soon. Read this before getting a piece of the CryptoPunks or Bored Ape Yacht Club NFT from fractional NFT marketplaces.

Table of Contents

What Is a Fractional NFT?

When an NFT owner splits one of their NFTs into smaller pieces, that gives rise to fractional NFTs. You can split your NFT into any number you want, but the minimum count is two. When an NFT splits, its price gets redistributed to the fractional pieces, and hence the cost of smaller NFTs decreases.

Parent NFTs are backed by ERC-721 tokens, whereas fractional NFTs are based on ERC-20 smart contracts. Thus, legitimate sales of fractionalized NFTs become possible.

NFT fractionalization always results in a smaller price per fraction of NFT share. But, you can get a price appreciation for the fractionalized NFT in total since more collectors want to buy a piece of the NFT. Mostly, it happens for highly popular NFTs.

For example, the Feisty Doge NFT was $35,000 in June 2021 before its fractionalization. But, after the release of its fractional NFT, the total value of the NFT attained a new high of $80 million.

Fractional NFTs: How Do They Work?

Traditional NFTs are non-fungible tokens that represent unique assets like paintings, digital arts, memes, and so on. These tokens usually use smart contracts like ERC-721 on the Ethereum network and BEP-721 on the BNB chain.

Now, fractionalizing such tokens involve splitting the NFTs into parts like 1,000, 10,000, 10,00,000, and so on. The target NFT gets locked into a smart contract during the fractionalization process. Then, the smart contract transforms into fungible tokens like ERC-20 on the Ethereum blockchain.

The newly created fractionized NFTs will include a new set of metadata, price, and other properties. Usually, the NFT holder determines which data to include in the ERC-20 smart contract tokens.

Finally, there’ll be a predetermined number of ERC-20 tokens. For example, you may own the Doodle #7675 of the Doodles NFT project and want to divide the ownership into 2 million fractions. Then there’ll be 2 million ERC-20 tokens representing the original NFT.

Now, you can list these NFT fractions as a pool or vault for the Doodle #7675 NFT on platforms like Fractional.art, Unic.ly, NFTX, etc., for sale.

Fractionalized NFTs also come with a buyout clause. You can buyout all the 2 million ERC-20 tokens from the secondary marketplace. Then, you can unlock the original ERC-721 token representing the complete NFT. It means you now own the entire Doodle #7675 NFT.

Fractional NFT Risk Factors

When an NFT is available in fractional value, it’s easy for the small NFT collectors to invest through the secondary marketplaces. However, consider the following risks before investing in such shared crypto assets:

1. Proof of Ownership

Copyright infringement and proof of ownership are two crucial due diligence you need to undertake. You must satisfy yourself through proper channels that the seller owns the NFT and the artwork it represents before investing.

Otherwise, the NFT project developer or brand who owns the intellectual property rights (IPR) can file litigation against the seller. Such activities can reduce the price of your NFT fraction holdings.

You also need to validate the actual NFT ownership of the seller through reliable platforms like Ethplorer, Etherscan, Etherchain, etc.

2. Absence of Regulation

There are no concrete laws, guidelines, or regulations around the fractional NFT platforms and marketplaces. Most of these are DAOs, and a community governs the platform activities.

It’s no secret that a few individuals with the most holdings have a say in such communities. Thus, your investment can take a hit if these big investors make wrong decisions.

3. Highly Volatile Market

Investor and collector sentiment is the pillar of the fractional NFT marketplace. Since the traditional NFT market is highly volatile, fractionalized NFT values are also unstable.

Also, some features of the existing NFT fragment marketplaces may change drastically when the Ethereum blockchain migrates to a proof-of-stake (PoS) consensus system.

4. Smart Contract Security Risks

Smart contracts are vulnerable to hacking attacks. Also, the seller or party that fractionalizes certain NFTs can make some mistakes in the smart contract management. Hence, learn about blockchain smart contracts before staking your money.

Fractional NFT Platforms

Followings are the NFT apps that you can follow for NFT fraction participation:

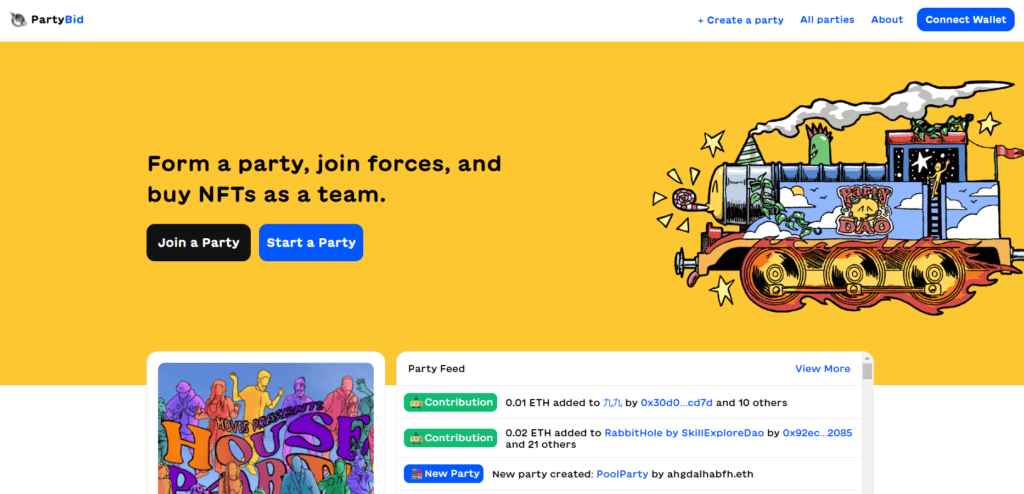

1. PartyBid.app

PartyBid is a decentralized autonomous organization (DAO) that enables the users to form a party of NFT collectors to buy high-value NFTs as a team. You can start a party of your own and attract other investors to buy fractional NFTs. Alternatively, you can join an existing party.

You’ll find trending parties on its website. The party owners name the parties according to the NFT they want to buy. For example, you can join Beerhat Fluf, Mutant Ape Yacht Club, MoonParty, or Mfers party to buy the respective fractional NFTs.

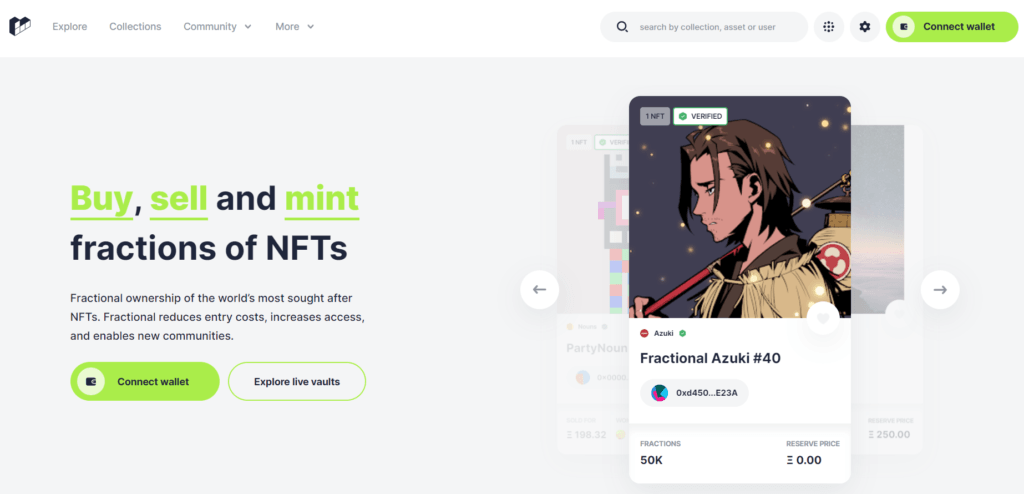

2. Fractional.art

Fractional.art is one of the most popular destinations for NFT investors to transform their ERC-721 NFT tokens into ERC-20 fungible tokens or fractionalized NFTs. Once an NFT holder creates fractions of their NFTs, the platform sets an initial value for each fraction and a buyout reserve price.

Fractional lists the smaller NFT pieces in the form of Vaults. NFT collectors can browse through these Vaults like The Doge NFT, PUNKS, Feisty Doge NFT, etc.

3. Niftex

Niftex is yet another popular platform for fractionalized NFTs hosted and accessible via its Interplanetary File System (IPFS) content delivery network. On Niftex, you can create shards of your NFT, similar to fractional NFTs.

You can pick your own distribution methods and pricing for the small pieces of NFTs before selling them at a fixed rate. It takes around two weeks for the overall process of fractionalization after which the fractional NFTs can appear in the market for trading.

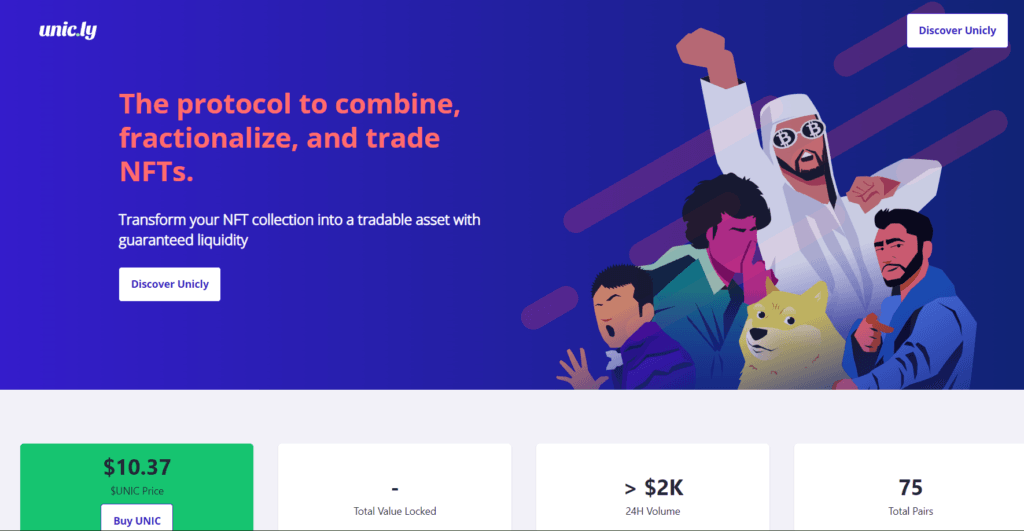

4. Unic.ly

Unic.ly is also a popular platform for fractionalizing NFTs, fractional NFT listing, and trading. It’s a decentralized finance (DeFi) app created by the NFT collectors and made truly decentralized through the governing token UNIC.

You can connect your cryptocurrency wallet with Unic.ly to create ERC-20 tokens against your NFT. On Unic.ly, this token is known as uToken. Different uToken pools represent a collection of fractional NFTs. Users can buy uTokens, trade uTokens, and stake their uTokens for yield farming on Unic.ly.

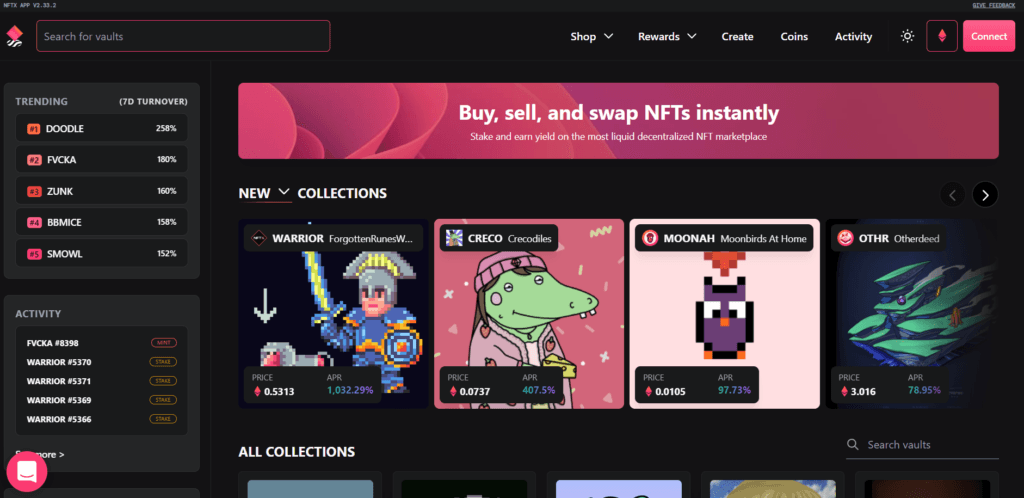

5. NFTX

NFTX also offers fractional NFTs for trading and collecting but differs conceptually from Fractional.art and Unic.ly. NFT holders can pool their equal value NFTs into index funds where all the NFTs have a similar rarity, and all sit at the floor price.

You can also buy a portion of the index fund instead of depositing NFTs into the pool. In both ways, you get vToken with a redemption claim ratio of 1:1. vToken is essentially an ERC-20 token representing fungible pieces of an NFT.

Fractional NFTs: The Final Word

So far, you’ve gone through an in-depth discussion of fractional NFTs and their technical aspects. NFT fractionalization concept is in its infancy and comes with investment risks.

If you’re willing to venture into the fractional NFT class, first you need to find out which NFTs are good. Finally, NFT fractionalization will boost the entry of retail NFT collectors and investors into the cryptosphere.