One infamous scam is NFT wash trading, where an NFT minter or seller pumps the price artificially to convince the buyer to buy it at an inflated price.

NFTs are becoming a popular asset class among the Gen Z investors who always crave technologically sophisticated financial products. Such emotions skyrocketed the overall transactions of cryptocurrencies in the Ethereum blockchain. The transactions reached at least $44.2 billion in 2021 from a mere $106 million in 2020, according to a Chainalysis report.

Since the crypto transactions directly pointed their fingers at ERC-1155 and ERC-721 smart contracts, it’s not tough to understand that these transactions were for NFTs.

With more money, the risk of scammers also increases. Bad actors rely on several illicit acts like wallet hacking, fraudulent soliciting, and the latest in wash trading. Read on to know more about NFT wash trades and invest wisely in non-fungible token assets.

Table of Contents

What Is NFT Wash Trading?

NFT sellers, minters, and investors sometimes perform malicious transactions to pump up the transaction volumes and prices of NFT assets. Technically speaking, an NFT seller would sell its holding to a blockchain wallet, financed by the seller themselves in disguise. Such wallets are often called self-financed wallets.

You could find one seller doing back and forth transactions to hundreds of NFT wallets in real-time situations. NFT marketplaces consider these transactions valid and inflate the overall NFT activity by day, week, or month accordingly.

An NFT collector or investor could perceive this higher transaction volume as a positive signal. It influences them to invest in a crypto asset that has been overpriced by malicious transactions. In NFT, cryptocurrency, and securities trading sectors such activity is known as wash trading.

If you notice the following activities in any NFT project, you should stay away:

- Unusual purchase activities of an NFT to stimulate a demand that’s not natural

- There is a pattern of transactions: going back and forth between a few wallets

- Flash buy orders to form a hype around an NFT asset, artist, or DeFi platform

NFT Wash Trades: How Does It Work?

The NFT wash trading requires a seller to hold more than one cryptocurrency wallet address. Most of the NFT marketplaces let you transact by simply linking a wallet.

There is no know your customer or client formalities. Hence, marketplaces can’t identify whether a single individual is linking multiple wallets with the intention of wash trading. Such a flaw enables fraudsters dupe NFT investors by offloading a junk NFT at a hyped price.

Here is a complete pathway of an NFT wash trade:

- The seller sells the NFT to someone. The owner of the recipient crypto wallet is the seller themselves.

- Then, they follow the same strategy to log more sell transactions by selling the assets to their own wallets.

- For each transaction, the seller needs to pay NFT gas fees.

- After multiple transactions, the final seller may increase the bid price excessively to make a huge profit.

- NFT collectors who consider transaction volume a key metric to invest in an NFT, buy the NFT out of speculation that they can also sell it later on with profit.

- Now, the genuine collector who has become a victim of an NFT wash trade can not sell it further since the price is overvalued.

NFT Wash Trading: Is it Illegal?

NFT wash trades are unethical and illegal since bad actors are manipulating the NFT marketplace data to dupe an NFT collector to buy an asset that has been priced irrationally. The US securities market watchdog Commodity Futures Trading Commission (CFTC) fined Coinbase Inc. $6.5 Million for various fraudulent activities, including wash trading.

However, some unorganized wash traders escape penalties or lawsuits since most countries have not recognized nor regulated the NFT and crypto-assets.

As a result, habitual wash traders have defrauded the NFT collectors many times via wash trading and made a staggering $9 million in profits, as reported by Chainalysis in the report mentioned earlier in this article.

But, the newly adopted Markets in Cryptoassets (MiCA) law by European Union (EU) should protect investors’ interests since it clearly defines wash trading as an illegal activity. So, if you’re in any of the EU countries, you may seek legal counsel to sue the seller if you have been a victim of an NFT wash trade.

Infamous Examples of NFT Wash Trades

Most wash trades go unnoticed since NFT collectors aren’t reporting the incidents. The lack of reporting could be due to the fact that investors don’t even understand that they have become a victim of wash trading.

The followings are some notable NFT wash trading incidents that you should know:

#1. The biggest scam of NFT wash trading is related to the CryptoPunk 9998 NFT. The seller sold the NFT to a self-financed wallet for 124,457 ETH. After some time, the seller returned the ETH to the buyer, and subsequently, the buyer listed the NFT for bidding at 250,000 ETH, almost $1 billion.

#2. The 600 ETH transaction record of one of the CryptoKitties NFT, the Dragon or Kitties #896775 is also a suspect of a wash trading scam. Experts believe its hyped price doesn’t correlate with the NFT’s rarity features.

#3. There have been reports of attempts that sellers of certain properties in the Decentraland metaverse have tried to portray assets as more valuable than their fair value.

#4. NFT and crypto experts have noticed malicious transactions to hype the platform metrics by SpiderDEX.

NFT Wash Trading: A Serious Problem for NFTs

Whenever there are too many scams and fraudulent activities in financial investment products, investors lose their faith and interest in the market. Subsequently, the economy built around the investment market fails. Investors lose billions of dollars of savings, pension money, social security, etc.

Since cryptocurrency and NFT assets are also decentralized and market-dependent products, excessive market manipulation will cause this ecosystem to fail. Therefore, any kind of market manipulation tactics, including NFT wash trading, is a serious threat to the NFT ecosystem.

The wash trading phenomena negatively affects all the participants of the NFT industry, and these are:

#1. NFT project owners will no longer receive reliable performance metrics of their NFTs from the secondary marketplaces. They’ll need to waste productive hours on cleaning market data while they could have worked on the development and growth of the project.

#2. Since wash trading pumps up the NFT marketplace with misleading statistics, traders and collectors will no longer be able to determine the correct value of an NFT asset. They may shift their focus to other popular crypto projects like Bitcoin, Ether, Tether, BNB, etc.

#3. Investors need to pay third-party analysts for due diligence on NFT assets they want to own.

Above all, NFT wash trades and subsequent scams become leverage material against the decentralization of finance. Mainstream and centralized financial institutions will use such scandals to persuade the securities market regulators to sanction NFTs and cryptos.

How to Save Yourself from NFT Wash Trading Scams

The thumb rule of protecting your investment in an open market is to conduct due diligence on the asset you want to buy. Don’t become a victim of the fear of missing out (FOMO) feeling that drives most of the high-stake NFT transactions.

Instead, go to the website of the parent NFT project and investigate the project scope, development plans, future roadmaps, real-life utility, etc. You can also join the Discord server of the NFT project and interact with existing members to know more about the asset.

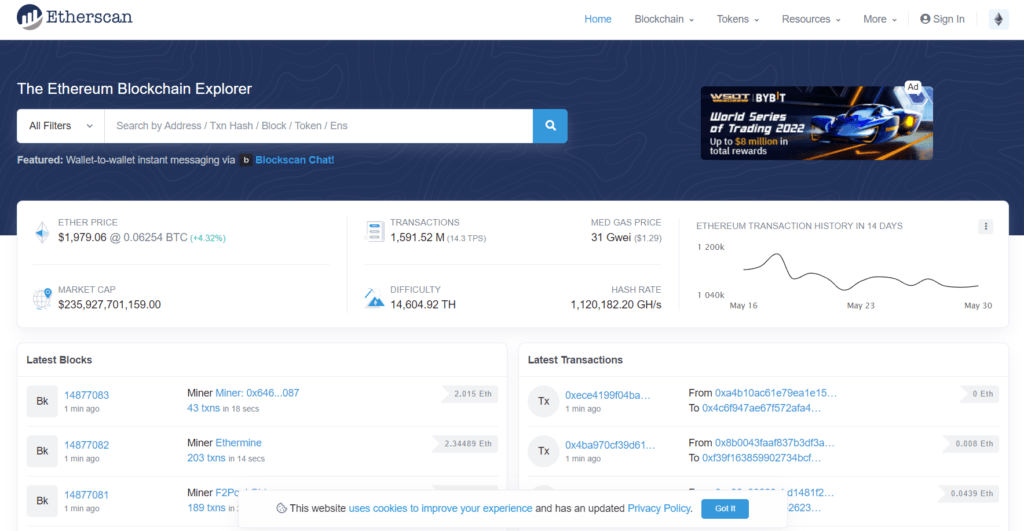

You can also use the Etherscan tool to explore the Ethereum blockchain for unusual transactions related to the NFT that you want to buy. If you notice any pattern in the transaction, like ETH and asset going back and forth to a few wallet addresses many times, it’s probably a wash trading attack.

NFT Wash Trading: The Final Words

Now that you’ve an in-depth understanding of NFT wash trading, you should stay safe from such scams when collecting NFTs. Always perform your own due diligence before investing in NFT and crypto products.

Here are the best NFT tools for further assistance in your NFT investment and collection journey. You may also want to check out the best NFT websites to grow your knowledge of NFTs.