Know what is a derivative NFT, how one can differentiate it from the other NFTs, and some popular derivative NFTs that you should follow.

A non-fungible token is a unique smart contract that represents an artwork, music, baseball card, or even an autograph of a celebrity on a blockchain network. When speaking about NFT minting, collecting, trading, etc., we mostly indicate the artwork NFTs since these are more prevalent than other creative assets.

Now, a collection of 5,000 or 10,000 apes or cats can’t be the end of creativity around these characters. There should be more avenues for creativity so that more artists can enter the NFT ecosystem, making it a truly decentralized token-based economy.

Here come artistically similar but characteristically different NFTs, that are spin-offs from highly-successful original NFTs, with or without permissions from the initial project.

Table of Contents

What Is a Derivative NFT?

Many NFT creators rely on the artistic creativity and intellectual property (IP) of an existing NFT collection and do a copycat job to mint their own NFTs. While some creators respect the intellectual property of the NFT project they’re following, most creators don’t and produce rip-offs of the original NFTs.

They do however change certain rarity traits of those copy-paste artworks by changing the hat color, orienting the face to left instead of right, or even mixing two different kinds of artistic approaches like voxels with pastel colors. These NFTs are widely known as derivative NFTs.

Derivative NFTs: Official or Unofficial

Most derivative NFTs out there are unofficial. However, you may also find some official derivatives like Mutant Ape Yacht Club (MAYC) and Bored Ape Kennel Club (BAKC) as official derivatives of the Bored Ape Yacht Club (bayc) NFT project.

Official derivatives tend to add value to the original NFT project by adding more assets to the existing collection. Furthermore, genuine NFT derivatives engage more community members with an existing NFT project and ultimately increase the project’s viability in the long run.

So, you may now wonder why would creating derivatives will increase the community engagement and activity? To understand that, you need to know that artists and creative content creators create NFT derivatives to ride the popularity wave that a blue-chip NFT is experiencing.

Also, derivative digital assets tend to have a lesser NFT floor price than the original NFT collection that it follows.

Therefore, BAYC NFT enthusiasts or community members who could not buy a bored ape due to the project’s high floor price can satisfy their fear of missing out (FOMO) feeling by buying a MAYC or BAKC ape, since these still are in the low floor price range.

Another important consideration to differentiate between official and unofficial NFT derivatives is by looking at the IP rights of a successful NFT project. For example, if you find NFT derivatives for projects like Nouns, HyperLoot, Mfers, Timeless, CrypToadz, and Blitmaps, they could neither be official nor unofficial.

Because the NFT project owners of these NFT collections have made their IP rights open to the public through CC0 NFT licenses. In fact, you can get inspiration from these NFTs and launch a line of own digital assets to shine your artistic career.

In a nutshell, stay out of unofficial NFT derivatives that copy creativity from non-CC0 NFTs or IP-protected assets. Because such projects might face stringent actions in the future when the NFT sphere comes under more regulations.

Differentiating Derivative NFTs From Genuine Projects

First off, whenever you look at a spin-off NFT, you’ll find the artistic composition and character construction is somewhat similar to some highly-successful NFT projects, like:

- CryptoPunks

- Doodles

- Cool Cats

- Bored Apes Yacht Club

- mfers

- World of Women

Secondly, you’ll also notice that the name of the individual NFTs or the collection as a whole is also a copycat of any genuine blue-chip NFT project. There could be some differences in the wordings, but the underlying meaning is similar.

Thirdly, the derivative NFT projects often borrow character styles, attributes, traits, special powers, etc., from the NFT collection(s) they’re copy-pasting.

Derivative digital asset creators follow all these tactics to somehow float the NFT collection along with the top NFTs on OpenSea, SuperRare, or LooksRare. This strategy drives the NFT sales however isn’t a sustainable way, and soon the derivatives with bad intentions will drown to the bottom of the list.

So, before collecting or investing in a derivative project:

- Look for the “Official” mention or a “Blue Tick” on the OpenSea marketplace

- After opening the NFT’s page on OpenSea, always go to the See More section to read out the description of the project

- Access the Discord or Twitter accounts of the derivative project and do your own investigations by mingling with existing community members

- Read through the roadmap or project goals on the Discord handle, if available

- Use any NFT Volume Trade tools like NFT Stats to look at the all-time volume and trading activities of the assets you’re interested in

Derivative NFTs To Watch: DYOR!

1. Bored Ape Solana Club

BASC is a collection of 6001 artworks as digital assets. The artistic characters are similar to that of the BAYC or bored apes. However, the most interesting feature is that the NFT project developers didn’t copy any rarity traits from the BAYC project.

Bored DAO (decentralized autonomous organization) launched the NFT collection with the intention to make it the next big NFT on the Solana blockchain. Moreover, the project comes with an elaborate roadmap which includes:

- Community-based fundraising as SOL coins to fund the project

- All the artworks are hand-drawn by internal artists of the Bored DAO team

- All NFT asset metadata have received a crucial update

So far the NFT is performing well with 74.5K SOL in total traded volume with a floor price of 18.8 SOL (floor price changes daily). As of now, 2.3K owners have participated in the project, and the OpenSea activity chart also shows an increase in trading activity.

2. CryptoPhunks

CryptoPhunks may look like a complete copycat work of the Larva Lab’s CryptoPunks. However, if you look closely and compare the characteristics of the individual NFTs, you’ll spot some differences.

First off, the original CryptoPunks are right-facing, whereas the CryptoPhunks are left-facing. Secondly, CryptoPunks have Type and Properties as their rarity traits. On the contrary, CryptoPhunks have simple facial look-related properties like beards, cheeks, ears, emotion, teeth, etc.

CryptoPhunks has its own NFT marketplace with no royalties or service fees. Also, the developers claim that the project is fully decentralized and anyone can contribute. Moreover, they’ve got a functional Discord and Twitter account to keep their followers informed and engaged.

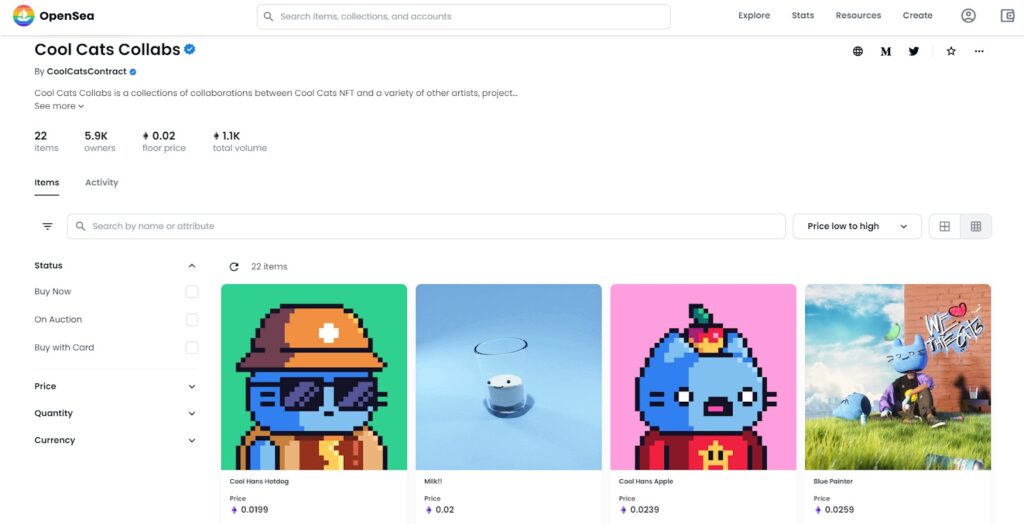

3. Cool Cats Collabs

Derivative NFTs could also allow unknown yet potential creative artists to flourish under big brands. One such successful example is the Cool Cats Collabs NFT project of 22 unique artworks of voxel art, pastel art, GIFs, and memes. Though, the project also features creators from different projects and brands.

Since the listing of this NFT, the collection attained a total ETH transaction volume of 1.1K with 5.9K total owners and an average floor price of 0.018 ETH (likely to change anytime sooner or later.)

4. AlphaBetty Doodles

Cheryl Griffin has created the AlphaBetty Doodles with inspiration and artistic features from the original Doodles NFT project. Though the NFT project utilizes the name Doodles, there are very few similarities in both the NFT projects like rarity traits body, background, hair, etc.

This is the first NFT project suitable for the whole family including kids. The project also showcases some promising roadmap guidelines. Moreover, as per the project’s website high profile social media influencers, athletes, and celebrities own some NFTs from this collection.

Derivative NFT: The Final Word

NFTs are already speculative asset classes, and derivative NFTs add more conjecture than value. Though some NFT spin-offs may be worth collecting, the general notion is to stay away from NFT projects that simply copy-paste a genuine creative asset.

You may decide to collect a spin-off NFT of a bored ape, a cool cat, or a punk, but do thorough research before investing.