Discover what is Metaverse NFT index in our guide for investors and collectors.

The number and type of NFT index funds are growing exponentially. It’s not unexpected since different types of investors are entering the NFT and cryptocurrency sphere.

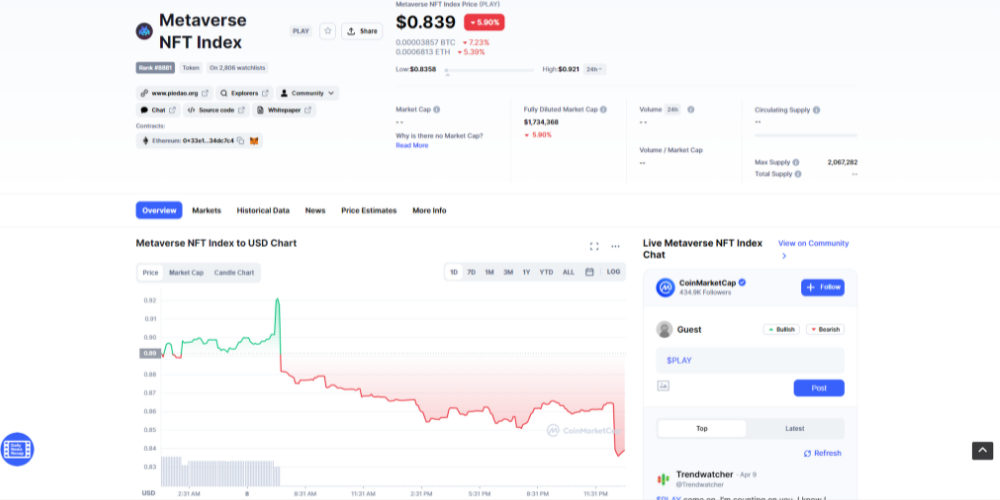

NFTs and cryptocurrencies are the ultimate tradeable assets for the metaverse. Some investors want gaining exposure to the market without buying individual NFT related tokens. One venture that aims to address that market gap is the Metaverse NFT Index, or PLAY.

Metaverse NFT Index or the PLAY brings the best of best blockchain gaming, metaverse, and Web 3.0 solutions in one place in the form of a single ERC-20 token. Everyone can get a share of the pie effortlessly without spending hours researching individual NFTs or their related tokens.

Confused? Learn what’s important about NFTs?

Table of Contents

What Is the Metaverse NFT Index (PLAY)?

The PLAY or Metaverse NFT Index is an index fund that captures the value generated by multiple projects that operate in one or many metaverses. When you get a stake in the PLAY token, the goal is profiting from the operations in metaverses while diversifying your crypto portfolio.

PieDAO and the NFTx platform created the index through a joint venture project. PieDAO is a community of experts focusing on automatic wealth creation through asset tokenization.

Before PLAY, it had successfully launched and ran multiple decentralized finance (DeFi) projects like Piefolio, Farms+DOUGHpamine, BCP, DEFI++, SLICE, etc.

On the other hand, NFTx is the popular marketplace where illiquid NFT projects find ample liquidity opportunities. While the PieDAO community handles research and due diligence of index tokens, the NFTx community provides token liquidity like minting ERC-20 tokens from ERC-721 NFT assets.

PLAY is one of the broadest and best metaverse indices in the cryptosphere. Its vision is to create a highly diversified NFT index portfolio covering most of the sectors that define the metaverse.

The sectors included are blockchain infrastructure, blockchain gaming, digital art assets, and rare collectibles in digital forms.

The Composition of PLAY Index Token

The collection of the index tokens changes from time to time, usually every month, the community re-evaluates and makes adjustments if necessary. The portfolio has changed since its inception and currently includes the following assets:

1. MANA

It’s the native token of Decentraland, one of the oldest metaverse. The metaverse uses MANA as the in-game cryptocurrency for transactions.

2. SAND

It’s the native token from the Sandbox Game, a famous Minecraft-style game with a microgame building feature.

3. AXS

Yet another popular token from the play to earn game AxieInfinity. It’s the governance token of this gaming platform and comes with voting rights.

4. ENJ

It’s the utility token of the Enjin blockchain for NFTs. Enjin is a robust blockchain game development platform that offers APIs, Wallet Daemons, Blockchain SDKs, and Trusted Cloud solutions.

5. ILV

It’s a multifunctional crypto token of the Illuvium play-to-earn game where you can collect sci-fi gaming characters as NFTs, wage war on fractions, or own Lands. ILV is the governance, liquidity mining, and vault distribution token of the Illuvium blockchain game.

6. GALA

GALA is the utility token of the GALA Games platform, a multi-gaming community with game building, playing, and investing, all in one place. Gamers and builders need GALA coins to buy anything within the ecosystem.

7. YGG

It’s a native token of Yield Guild Games, a community of play-to-earn gamers. The DeFi platform invests in blockchain-based gaming NFTs.

8. AUDIO

Audius is a Web 3.0 music distribution platform that utilizes blockchain technology. Its native crypto coin is AUDIO, which also serves as the governance token for the platform.

The Asset Allocation Policy for PLAY

The Correlated Risk-Adjusted Market Cap is the primary asset allocation policy of the Metaverse NFT Index. In simple words, the index values the assets based on the 30-day average circulating market capitalization.

Then the percentage of allocation is decided by considering the followings:

- Minimum 2% allocation for each asset

- A single large-cap holding is allocated a maximum of 30%

- The top 3 large-cap assets are capped at a maximum of 60% of their cumulative allocation

The Asset Inclusion Criteria for PLAY

The PieDAO community has a set of criteria to include an asset in the PLAY index. First of all, the asset has to be linked with metaverse and must come from Ethereum or other blockchain networks. Then, there is voting among the community members who hold DOUGH tokens, the governance token of PieDAO. Other key considerations are:

- The NFT project should have a native or governance ERC-20 token. Those who don’t have one can mint such tokens from NFTx.

- The NFT coin should have certain liquidity values. Liquidity on a decentralized exchange of $ 0.5M+ or greater than 10% of the circulating market cap, whichever is more.

- The project should have some kind of utility in NFT clusters, metaverses, blockchain gaming, and blockchain infrastructure development sectors.

- The asset should comply with the fractional NFT concept.

Index Rebalancing Policy

Similar to conventional index traded funds, the Metaverse NFT Index also reconstructs the index by evaluating old assets, eliminating non-performing ones, and onboarding new high-performance NFT assets.

The policy consists of a subset of index objectives that play the role of triggers for rebalancing. Any one of the below two activities of assets will trigger a rebalancing call:

- The maximum cumulative allocation of the top 3 assets is more than 80% for straight 7 days.

- The maximum allocation of the largest asset holding is more than 50% for consecutive 7 days.

It also considers the community consensus which is known as rebalancing urgency, and the considerations are:

- The acceptable rebalancing frequency is once per calendar month.

- If the index considers a new asset for inclusion, that won’t trigger a rebalancing event. Inclusion will be done during the next rebalancing.

- Every 6 months, there should be at least one rebalancing.

Index Rebalancing Procedure

The PieDAO community will meet for a voting session to rebalance the Metaverse NFT Index when the community detects any one of the two rebalancing triggers has been activated.

Apart from that, all the guidelines for the community-based rebalancing urgency must exist. Then, any member of the PLAY Pie community can call for a rebalancing.

The Benefits of the Metaverse NFT Index

Most NFT investors and traders complain that investing or trading in this sector requires a lot of technical expertise and research.

Ever-increasing gas fees for the Ethereum blockchain transaction also take out a big chunk of profit as fees. That’s the reason PieDAO and the NFTx have introduced PLAY token that:

- Reduces or mitigates the issue of gas costs in investment position maintaining

- Diversify investment portfolio without going through the hectic asset research

- Delegating the task of due diligence and asset research to the PieDAO community

- Invest in an asset class that has higher growth potential in the future

Metaverse NFT Index: The Final Words

Metaverse has already become the future of digital technology and virtual reality (VR). More investors, traders, creative content creators, and digital artists will venture here to buy lands, trade virtual real estate, play games, host virtual art exhibitions, and so on.

In the coming days, the sector will see mammoth growth, and as the platform matures, the early investors will reap the best profits. Therefore, the PLAY token is one such opportunity for you to enter the metaverse world as an investor without shifting focus from your day job or business.

If you love NFTs and want to collect some, you need to know about these top 8 NFT blockchains.