A market index is necessary to gauge how the market is performing. One such index for the NFT ecosystem is the NFT Index.

With the massive growth in the number of NFTs, there comes a need to form a hypothetical portfolio or index of non-fungible tokens (NFTs) and NFT-related coins. Hence, decentralized finance and Web 3.0 developers have developed several NFT indices.

These NFT indices include some bluechip NFT projects. One can invest in multiple NFTs by buying a portion of these NFT indices. Almost all such projects also offer a governing token for the community of investors, so the index doesn’t become a centralized financial product.

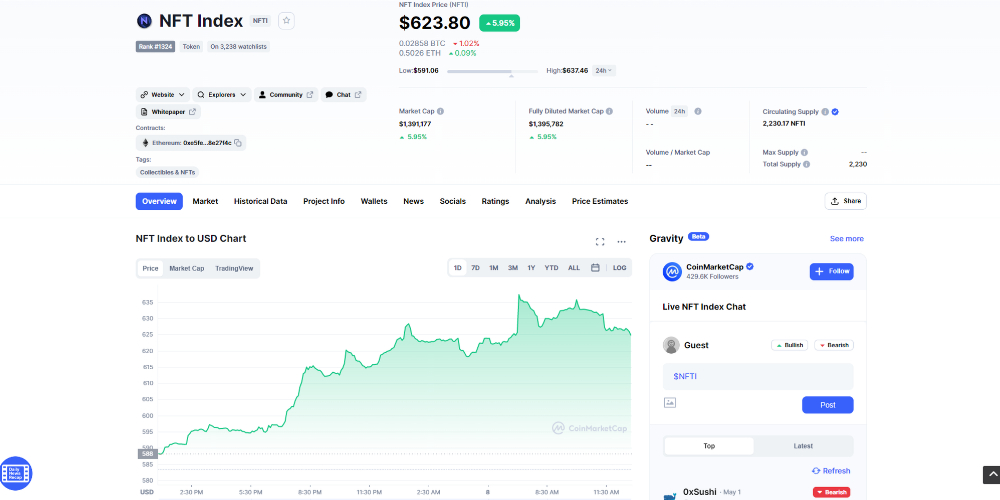

One index that has particularly gained momentum since its inception is the NFT Index. Its symbol on popular exchanges is NFTI.

Table of Contents

What Is the NFT Index?

The NFT Index is a crypto asset index developed by Crypto Art Fund and Pro Blockchain. It monitors blockchain-based digital assets like cryptocurrencies, NFTs, and metaverses and their performance.

The circulation supply of each token contributes to weighing the value of the NFTI index. It currently focuses on high-quality digital assets like NFTs and metaverses in the decentralized finance (DeFi) sector. Some of the quality parameters that the NFT Index follows are a roadmap for future developments in the NFT project and regular maintenance.

Alt-text: The performance chart of NFTI on CoinMarketCap

As an investor, you can buy a stake in the index as units of NFTIs. To monitor the unit price, movements, and other trade activities, you can visit DeFi platforms like CoinGecko, CoinMarketCap, Binance, etc.

Like other DeFi projects, NFT Index has a governance token to let the token owners decide project development roadmaps. This token is known as the GNFT token. Owners of the token also receive a percentage of commission from NFT Index, just like receiving dividends from holding stocks.

The Digital Assets of the NFT Index

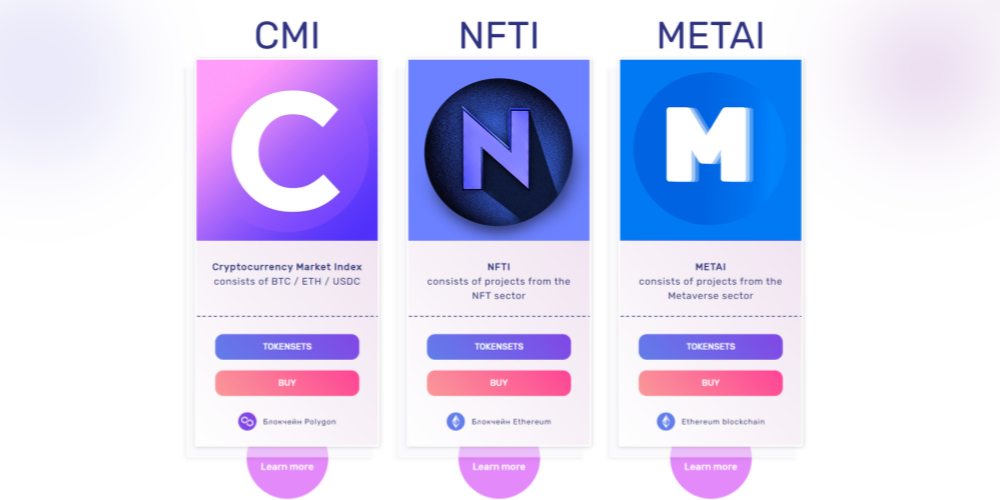

In the present day, the NFT Index isn’t only an index fund consisting of NFT coins. Instead, it diversified the initial portfolio to cryptocurrencies, NFT coins, and metaverse coins. The followings are the three different asset classes that compose the overall NFT Index:

1. Cryptocurrency Market Index (CMI)

CMI is a cryptocurrency asset index that the NFT Index uses to track the performance of the crypto-based financial market. The index gets its value from ETH, WBTC, and USDC in an equal percentage. Thus, if you hold one token of CMI, you diversify your investments in the whole cryptocurrency market.

The index calculation follows the following formula:

TW = (⅓) X IV

In the above formula,

- IV = Index Value (in USD)

- TW = Token Weight in CMI

All three constituents of the CMI index are high-quality assets. For example:

- WBTC has a Bitcoin backing ratio of 1:1

- ETH is the backbone of the NFT sector and is also used in most of the DeFi apps

- Regulated financial institutions issue USDC and are completely backed by reserved assets

You can check out investment opportunities on this index fund from Uniswap and Sushiswap.

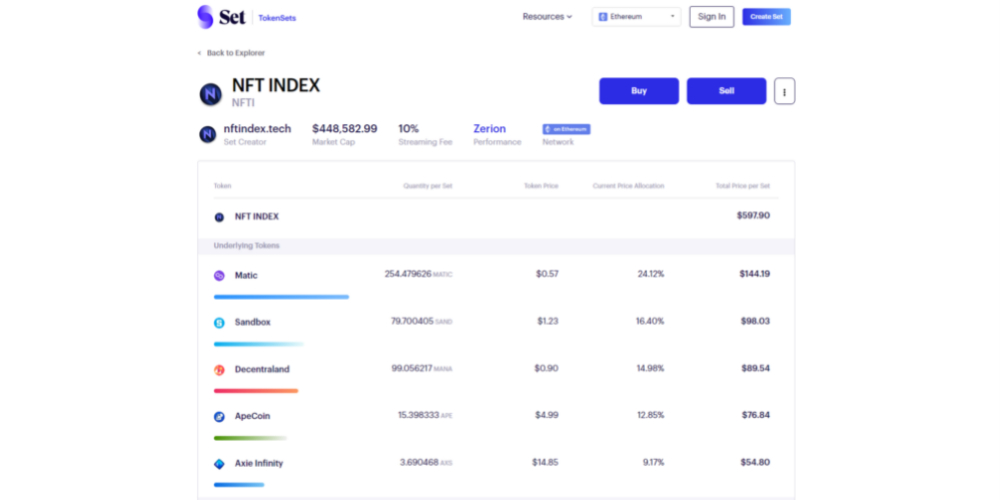

2. NFT Project’s Index (NFTI)

NFTI is the 2nd asset class of the NFT Index that helps you track the financial performance of the NFT industry. It monitors DeFi assets based on the capitalization-weighted formula. It means the market cap of the NFT project is given maximum weightage. The index also considers the liquidity value of each token.

Currently, the portfolio of the NFTI includes 10 NFT projects. These are Matic (24.13%), Sandbox (16.29%), Decentraland (15.01%), ApeCoin (12.82%), Axie Infinity (9.19%), WAXE (6.65%), Enjin (6.04%), Yield Guild Games (3.98%), LooksRare (3.97%), and Illuvium (1.92%).

The tokens in the NFTI change from time to time when rebalancing takes place. As you may notice, the tokens of the NFTI index have drastically changed from its time of inception. The index managers have removed Meme, Rarible, and Aavegotchi from NFTI.

Nevertheless, they’ve included 5 more coins, namely ApeCoin, WAXE, Yield Guild Games, LooksRare, and Illuvium. Now, instead of 8, there are 10 NFTs in the index fund. You can buy units of NFTI from the Uniswap liquidity platform.

To construct the NFTI index, the creators followed the following formula:

TW = 70% X RMCW + 30% X LW

In the above calculation,

- TW = Token Weight

- LW = Liquidity Weight

- RMCW = Root of Market Capitalization Weight

3. Metaverse Sector Projects (METAI)

If you’re excited about the metaverse projects and want to know how digital tokens perform within certain metaverse, you can follow this index fund. The METAI index diversifies the investors’ funds in 8 metaverses.

These projects are Sandbox (25.62%), Decentraland (18.98%), USD Coin (15.46%), Aavegotchi (14.10%), Ovr (10.10%), Somnium Space Cubes (5.73%), Neos Credits (5.48%),

and Netvrk (4.53%).

The index follows the metaverse project’s market cap and liquidity in decentralized exchanges (DEX) as the weighting factors. The formula is as below:

TW = 70% X RMCW + 30% X LW

In the above function,

- TW = Token Weight

- LW = Liquidity Weight

- RMCW = Root of Market Capitalization Weight

So far, you’ve learned about all three asset classes of the NFT Index. Combining all these assets in three different sections, the index fund’s total value locked (TVL) amount is more than 5 million USD.

Also, the index managers consider CMI, METAI, and NFTI for the valuation of the GNFT coin.

Thus, NFT Index isn’t just an index fund for NFT but also for cryptocurrencies and metaverse projects. So, when you invest in it, you’re truly diversifying your funds in the complete crypto ecosystem.

Maintenance of the NFTI Index

The NFT Index’s assets aren’t fixed. The index managers keep on rebalancing and adding new assets depending on the market. For reconstruction of the index, there are two phases:

Determination Phase

In the third week of a month, each index goes through the determination phase. The index managers remove any existing tokens and add new ones in this phase. They also update the circulating supply of each token from CoinGecko.

Reconstitution Phase

The outcome of the determination phase decides the roadmap for reconstitution. It usually happens on the first working day of the next month. In this phase, the index composition and weighted values of tokens change to new tokens and values.

Navigating the NFT Index

The user interface (UI) of the NFT Index is quite simple and clutterless. There are just 3 components that you can interact with. For example, if you want to get CMI tokens simply click on “Buy,” and the QuickSwap app will open in a new browser window.

Similarly, if you click “Buy” under NFTI and METAI, you’ll be routed to the Uniswap portal. Both QuickSwap and Uniswap offer you multiple token exchange opportunities to buy CMI, NFTI, and METAI.

Now, if you want to check the updated asset list and weighted values, you can click on the TokenSets button below each index tool. The portal will take you to the TokenSets website that shows the individual tokens and their percentage in the valuation of the index fund.

The Benefits of the NFT Index

1. The NFT index minimizes volatility, especially in the cryptocurrency segment, by including assets that have strong positions, liquidity, and market cap.

2. If you choose to invest in this index fund, you don’t need to perform individual research on each constituent asset of the index. The fund managers have already considered various asset qualities before including those.

3. The NFT index doesn’t suffer from impermanent loss because it uses the market cap for weighing a token proportion within the index. impermanent loss is the price difference of digital assets with time as they’re being deposited in an exchange or liquidity pool.

Investments in NFTs and other digital assets are always risky. Hence, you must perform your due diligence on this index fund before staking your money. You can check out the Twitter handles of Pro Blockchain and Crypto Art Fund for news and tweets about NFT Index.

NFT Index: The Final Words

The rise of NFT indices will increase the number of DeFi avenues where NFT and crypto enthusiasts can engage for investments, trading, learning, and becoming a part of the Web 3.0 transformation.

One such index you can check out is the NFT Index (NFTI). It’s a collection of multiple digital assets like cryptocurrencies, NFTs, and metaverses. Besides, it has its own governance token to distribute the voting powers to the community that invests in it. Moreover, the token owners can get a share of the profit from NFTI.

Since you find the NFTI project interesting, you may also want to read this ultimate guide on Fractional NFT.