Discover why do people hate NFTs and if they’re right in this analysis.’

Non-fungible token was a 2021 Collins Dictionary word of the year. Astonishing six and seven-figure sales of NFT projects, like the CryptoPunks and Bored Ape Yacht Club, made headlines. Celebrities like Paris Hilton even Tweeted about their holds and went on television chat shows, talking about their overpriced JPEGs.

So where did it all go wrong? The NFT market has plunged into a brutal bear market, and many have written the space off. Mainstream media has published multiple news stories describing NFTs as stupid, overpriced and a trend that should go away. Even Bill Gates got in on the act, saying NFTs are based “on the theory of the greatest fool.”

Gamers have revolted against NFTs, and Microsoft Minecraft says it wants nothing more to do with them. And YouTube content creators have published viral videos explaining why NFTs are nothing more than a fad.

So why is it that so many people hate NFTs? Are they right? In this article, I explain why people hate NFTs and offer arguments against what critics say about the prospects for non-fungible tokens.

Table of Contents

NFTs are Hard To Understand, Let Alone Buy

Onboarding into the NFT space isn’t easy. You must set up an account with a cryptocurrency exchange like Coinbase or Kraken, load it with some FIAT and then purchase Ethereum.

Next, create a software wallet using a service like MetaMask and transfer Ethereum using a weirdly complicated address of numbers and letters. After that, research the NFT market, figure out which ones are legit and pick one to buy that’s affordable and not a rug pull.

After that, learn to keep your wallet secure and potentially invest in a hardware device. This process doesn’t take long for somebody who’s been in the cryptocurrency space a while to do, and wallet security is basic hygiene.

However, onboarding is off-putting for somebody who doesn’t know much about cryptocurrency or NFTs and can take hours to learn. Even the word ‘fungible’ sent many off to the dictionary and see what it means. A clever marketing ploy by Collins Dictionary, perhaps?

Fungible means something divisible or easily replaceable, like a dollar. Non-fungible means indivisible or irreplaceable like a rare stamp, coins or crypto art. Read our guide to NFTs and artificial scarcity to learn more.

People are sceptical of new technologies, at least at first. It’s easy to criticise technology we don’t understand, like the internet circa the mid-1990s, as Bill Gates can attest to!

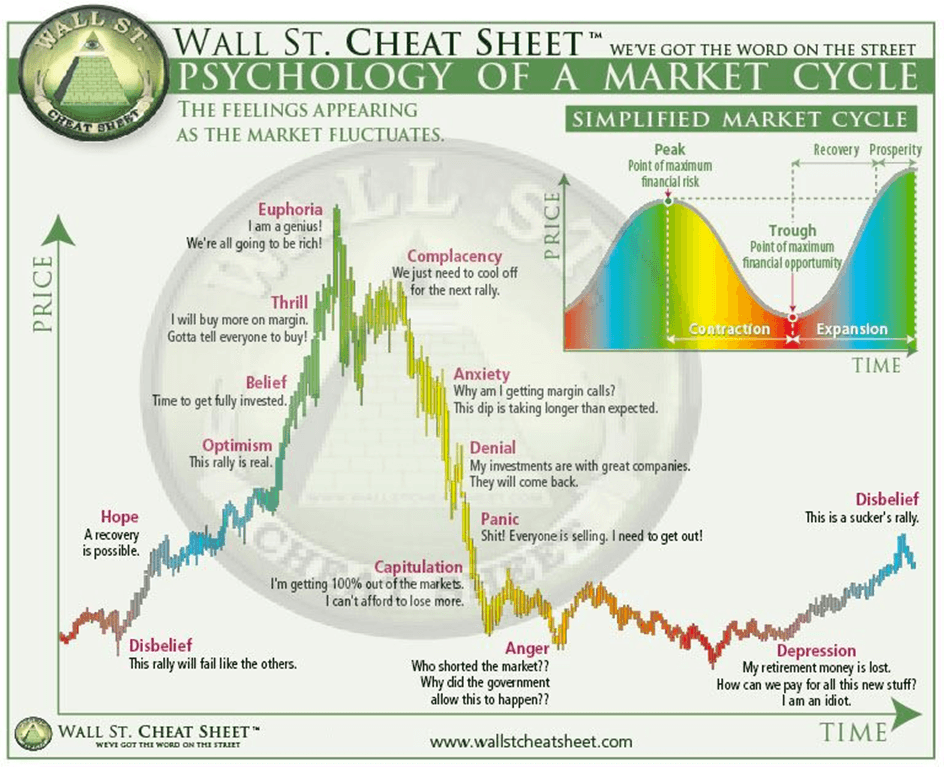

New technologies come with a learning curve, and it takes time to move past the early adopter phase. In 2021, the NFT market hit peak euphoria. Today, it’s mired somewhere between anger and depression.

Solutions like the Ethereum Name Service or ENS simplify how people manage their NFTs and cryptocurrency. But, we’ve got a long way to go before onboarding becomes painless.

The NFT Space Contains Too Much Ego and Money

A Bored Ape Yacht Club owner famously went viral on Twitter when he said he wouldn’t talk to anybody with a picture-for-profile (PFP) NFT worth less than a hundred grand or six figures.

Those types of tweets represent the worst of NFTs. They’re nothing more than greed and avarice. Spend any time on NFT Twitter, and you’ll find similar sentiments from people who talk about how great they were because they managed to mint Bored Ape Yacht or some other NFT and made a digital fortune early in 2021.

Boastful tweets rub people outside the space the wrong way. First doesn’t mean an NFT holder, no matter their PFP, is better or wiser than those onboarding today.

The 2021 NFT space may have inflated people’s egos, but their bubbles were rekked during 2022. Many have left.

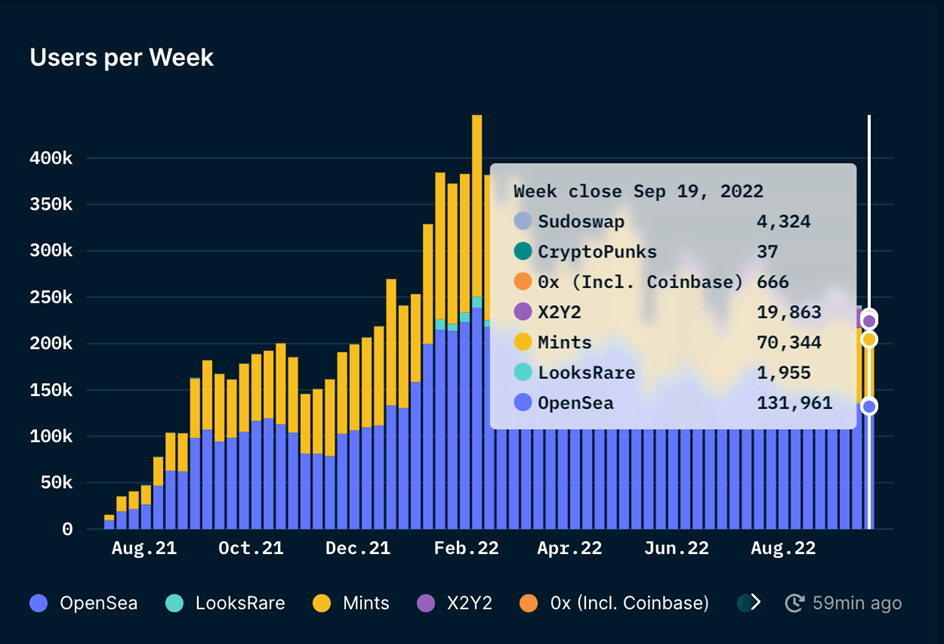

NFT trading volume on marketplaces like OpenSea is down over 80% since the bear market commenced in May 2022. The NFT space was overdue a clear-out. However, OpenSea still claims over 131,961 users for the week closing September 19th versus 98,568 for the same week last year. That’s before considering trading volume on newer marketplaces like Sudoswap, LooksRare and X2Y2.

The NFT market was overdue a steep correction. The current bear should clear out many bad actors and leave only those here to build rather than take quick profits and boast.

Many overpriced NFTs are more affordable too. New adoptees can also pick up cheaper NFTs on Tezos, Solana and Cardano. They can also pick up an Ethereum Name Service (ENS) NFT related to a brand or business for a few dollars a year and learn how NFTs work without losing a fortune. Read our ENS domain name guide.

Most NFT Artwork Sucks

Art critic Jonathan Jones took to The Guardian to criticize NFTs for their artwork, saying they were nothing more than JPEGs and memes. He wrote:

‘…as the Bored Ape Yacht Club makes horribly obvious, they serve nothing but money. They are just simian poker chips that celebrate the thrill of the market. A purer form of capitalism has never existed.’

NFT projects like Pixelmon didn’t help. That overhyped NFT generated over $70 million earlier this year. When the NFT was revealed, collectors were horrified by the cheap artwork. Project creator Syber issued an apology, called the artwork ‘unacceptable’, and recreated it all, but not before the Kevin NFT from the project became a meme.

Many NFTs look like cheap creations somebody knocked up in Photoshop or MS Paint, but that doesn’t take away from the creativity of blue chip NFT artworks.

But modern art is weird too. Ask any contemporary art critic who values Tracey Emin’s 1998 Unmade Bed. Her creation of an unmade bed littered with bodily secretions was exhibited in the Tate Gallery in 1998. In 2014, it sold via Christie’s for £2,546,500.

NFT projects released by Artblocks like Chromie Squiggle and Memories of Qilin are great examples of code as a type of art. Those who don’t enjoy NFT art don’t have to collect or buy it.

It’s a subset or niche for people interested in the digital art space. Like rare stamps or coins, one person’s simian poker chip is another’s prized possession.

People Feel They’ve Missed Out

The NFT space reached peak hopium when Paris Hilton appeared on the Tonight Show with Jimmy Fallon, and both showed audiences pictures of their Bored Ape Yacht Club NFTs. They talked about what these represented. Months later, Eminem and 50 Cent performed in a metaverse with their Bored Ape Yacht Club NFTs.

While publicity like this raises awareness about what NFTs are, those new to the space are put off when they learn a Bored Ape Yacht Club costs six figures to purchase. They feel like they’ve missed out and are angry and annoyed by smug holders.

The good news is we’re still early Bored Ape Yacht Club cost just 0.08 Eth to mint over a year ago. And the CryptoPunks was free to mint back in 2017.

Many of tomorrow’s Blue Chip NFT projects have yet to be created, let alone minted. While a Bored Ape Yacht Club or CryptoPunk may be beyond the budget of most today, chances are they can pick up a much more affordable NFT on Solana or Tezos or even on Ethereum. They could also potentially pick up an Ethereum name service domain and learn more about the use cases of ENS.

Not every NFT needs to become an overpriced ape JPEG, either. Consider the last time you took an online course and received a completion certificate. These certificates could become NFTs verifying an owner’s achievements and skills. Instead of pasting and sharing on LinkedIn, they could use these NFTs as part of their online identity.

NFT Twitter is Full of Hopium And Scams

Spend any time on NFT Twitter, and you’ll quickly see bots and scammers tweeting furiously about free mints and airdrops and professing to represent customer support for big projects.

You’ll also find NFT influencers tweeting about how they’re so freely buying NFTs and how much money they will make. However, many of these tweets are misleading and damaging to the space.

Thankfully, now that we’re in a bear market, many scammers will exit because there is less money to harvest. Similarly, those who relied on Hopium to shill their NFT bags have either been called out by NFT Twitter or are shilling to a small audience.

When the NFT market recovers, those entering should consider what they read or see on Twitter as nothing more than Hopium… and with a healthy amount of scepticism. Meanwhile, a project like ENS is delivering on use cases.

NFTs are Forced on People

The Irish band U2 famously made headlines worldwide in 2014 when they released their album, Songs of Innocence. They signed a deal with Apple whereby every iTunes user received a free copy of this album.

This free album was great for U2 fans, but those who hated the band disliked that Apple had deposited an album they didn’t want into their library.

Passionate gamers dislike the idea of crypto and NFT being forced into their virtual worlds. After all, who wants a bunch of NFT traders and speculators driving up demand for and the price of in-game assets?

Web 2 gamers didn’t ask for NFTs, but that doesn’t mean the NFT community can’t build a pure AAA Web 3 game. Ethereum was partly born of Vitalik Buterin’s dislike for what Blizzard did to this World of Warcraft Wizard. He wrote:

“I happily played World of Warcraft during 2007–2010 but one day Blizzard removed the damage component from my beloved warlock’s Siphon Life spell. I cried myself to sleep, and on that day I realized what horrors centralized services can bring. I soon decided to quit.”

Valve and Microsoft’s decision to ban NFTs may have more to do with these companies projecting their in-game centralised economy than a dislike for the format. Regarding the Minecraft NFT ban, developers said:

“We recognize that creation inside our game has intrinsic value, and we strive to provide a marketplace where those values can be recognized.”

A centralised marketplace they control with Microsoft taking a cut, and not independent NFT creators, perhaps? Many regard Microsoft Activision Blizzard’s purchase for $75 billion in January 2022 as a Metaverse play.

Virtual worlds and valuable in-game goods will become a more significant part of the Metaverse, including games… and these goods will be created and sold by big tech or independent creators and owners.

Perhaps pure web 3 games should be built from the ground up with NFTs in mind rather than fostering NFTS into classic titles and made backwards compatible?

In a true Web 3 game, NFTs could enable marketplaces and interoperability between titles. A willing gamer can genuinely own their assets rather than licensing them from the developers. That’s similar to what NFT Worlds and DigiDaigaku want to achieve. LimitBreak, the latter’s parent company, raised over $200 million to create its Web 3 game.

NFTs are Bad for the Environment

Thanks to proof of work, Ethereum reportedly consumed as much electricity as Chile annually. Buying and interacting with NFTs on the Ethereum blockchain was terrible for the environment and wasted energy. However, on September 15th, Ethereum finally moved to proof of stake.

European Commission’s financial policy chief, Mairead McGuinness, told POLITICO: “In a time where we’re talking about energy, energy, energy and reducing consumption and concerns around blockchain, this is positive. Anything that reduces consumption in this area is welcomed, and the extent of the potential cost is quite enormous and necessary.”

Now, Ethereum is 99.5% more energy efficient, including NFT transactions. You can also pick up much cheaper and more affordable NFTs on blockchains like Solana, Cardano and Tezos. These costs are only a couple of dollars and are incredibly energy efficient.

Ethereum’s move to proof of stake opens the blockchain up to centralisation risks but mitigates many issues environmentalists have with the NFT space.

NFTs Are A Type of Theft

NFTs have attracted attention for how they infringe on copyright. In many cases, unscrupulous groups took artworks and creations that didn’t belong to them, turning them into NFTs and extracting as much Eth as possible from the market.

Aja Trier is one example of an artist who called out NFT degens for minting and trading her creations without permission.

Adam Ferriss is another example:

In May 2022, Nathan Ello reportedly minted a collection of freely available NiFTy games like Galactic Wars and Rogue Fleet. He earned 8.4 Eth plus a cut of secondary market sales without permission from the game’s creators.

Copyright is an accepted legal construct which proves ownership, whereas NFTs represent a new technical concept proving ownership. Anyone can inspect a blockchain transaction for themselves to verify who owns a token. To bridge the gap between copyright and NFTs, A16Z Crypto has created a Can’t Be Evil NFT licence for project creators. These NFT licences may help minters and traders decide what to buy versus skip.

NFT sales on the secondary market are a potential boon for creators, despite intellectual property teething issues. Traditionally, when an artist sells a painting, they earn a percentage of that first sale. Similarly, when an author sells a copy of their book, they make a percentage of book royalties from that initial sale. However, artists, authors and creators don’t earn residuals from the secondary market. Collectors and brokers do.

Through creator royalties, artists can earn a percentage of any future sales on the secondary market. They can use NFTs to build relationships with their audience and a thousand true fans and support their career over time. NFTs, if done right, can eliminate the middleman between an audience and creators.

Why Do People Hate NFTS? The Final Word

People hate NFTs for different reasons, including the fact that they’re bad for the environment, overpriced and a bewildering fad. It’s no wonder many wish NFTs would go away.

The NFT space is indeed full of issues which need to be resolved. However, we’re already seeing significant progress. Ethereum moving to proof of stake is one example, as NFTs are now environmentally friendly.

Similarly, the NFT bear market means many influencers in for a quick flip have left. It’s giving those remaining in the NFT markets time to build and create something meaningful.

NFTs are great for anybody who creates content or wants to support their favourite creator’s work. Tomorrow’s Blue Chips have yet to be minted, let alone dreamed up. We’re still early. WAGMI!