Why Do NFTs use so much energy? It’s due to the underlying blockchain’s consensus mechanism on which they are minted, which currently utilizes Proof-of-Work.

Non-Fungible Tokens (NFTs) have taken the cryptocurrency industry by storm but their popularity has led many to question why they consume so much energy and what can be done about it?

NFTs emerged in 2017, today projects like CryptoPunks and Bored Ape Yacht Club have become part of internet culture. To learn more, read our NFT timeline.

While each individual Bitcoin or Eth token has the same value, some NFTs are worth millions, others are worthless. Even NFTs from the same collection vary in value. In short, one Bored Ape Yacht Club NFT isn’t worth the same amount as another NFT from the same collection. Instead, their price is determined by rarity traits and demand.

Today, the creation (minting) of a single NFT uses 142 kWh, 83 KgCO2, while the process of transferring ownership uses 52 kWh, 30 KgCO2. So minting and interacting with NFTs can leave a large carbon footprint as a result. But why?

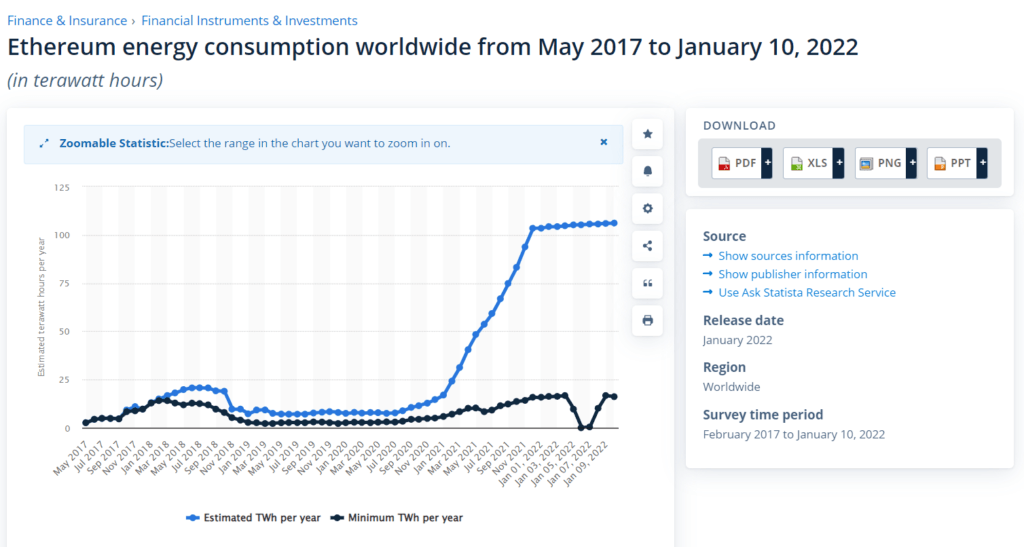

NFT Energy Consumption

The mining process for Ethereum is made up of a web of mathematical computations, all of which need to be solved using raw computational power. Based on analytics, as of January 1, 2022, Ethereum’s energy consumption on a worldwide basis, on an annual scale, is equal to 103.59 TWh. The Ethereum blockchain processes over 1.123 million transactions per day.

To put these stats in perspective, one Ethereum transaction is equal to powering an entire house for a day. That’s because Ethereum relies on the Proof-of-Work (PoW) consensus mechanism, much like Bitcoin (BTC). This mining process requires energy-intensive computing power.

These computers essentially take turns solving computational problems, much like guessing the combination for a digital lock. The Ethereum miners solving these problems charge users of the Ethereum network Gwei or gas fees. These fees can fluctuate wildly if the blockchain is congested.

As is the case of Bitcoin (BTC) or Ethereum (ETH), NFTs are a type of digital asset distributed predominantly on the Ethereum blockchain. When you purchase an NFT, you’re buying a unique certificate of ownership, which is locked within an immutable distributed database known as the blockchain network.

When Ethereum moves to PoS, it’s fair to say the energy costs of NFTs will drop dramatically. Ethereum 2.0 will use a more environmentally-friendly mechanism that cuts the carbon footprint of NFTS to a nominal amount.

Michael Rauchs, a research affiliate at the Cambridge Centre for Alternative Finance, told the Verge about proof-of-stake:

“That would essentially mean that Ethereum’s electricity consumption will literally over a day or overnight drop to almost zero.”

Some NFT providers are already circumventing this issue of energy-inefficient NFTs by releasing them on more energy-friendly layer two networks like Polygon and Immutable X.

For example, Polygon, which is formerly known as the Matic Network, blockchain is more eco-friendly, faster, and efficient compared to Ethereum. It uses a Proof-of-Stake (PoS) blockchain and Commit Chain connectivity to scale.

Other layer 2 networks like Avalance and Arbritrum bumble up transactions and send them back to Ethereum for validation in bulk, which harnesses economies of scale and gain leads to reduced energy costs. However, fewer bluechip NFTS are available on these networks.

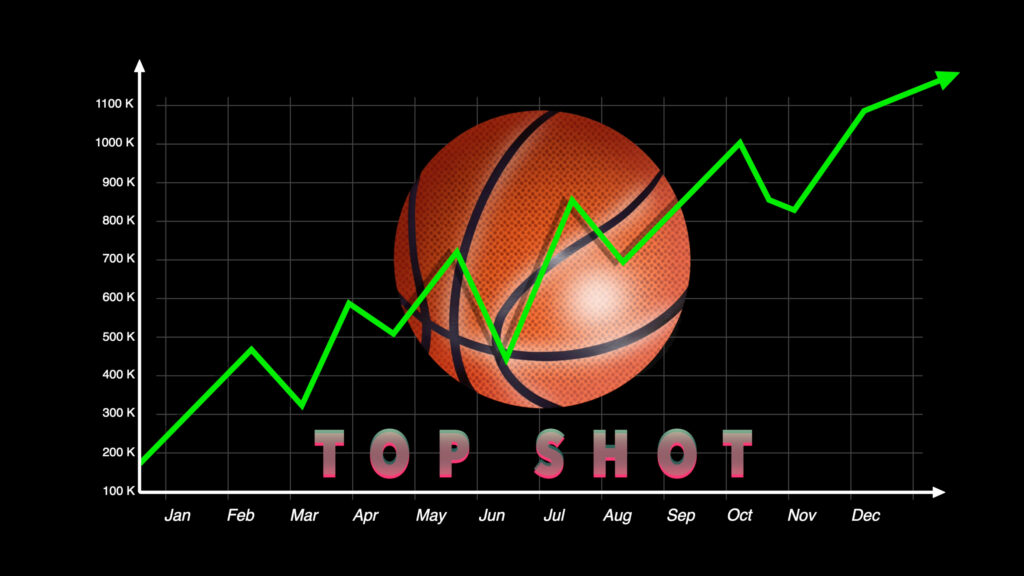

Energy-efficient blockchain alternatives to Ethereum exist too. Creators of NFT projects, like NBA Top Shots, use more energy-efficient blockchains like Flow.

Although more centralized than a PoW mechanism, it uses far less energy. Instead, users lock up some of their tokens from this blockchain to prove they have a stake in the ledger’s accuracy. As a result, transactions resolve to rely on how much tokens holders own rather than on pure computational power. The result is a much more efficient minting and purchasing process for NFT creators and buyers.

Read our guide: What Is Immutable X?