Are you wondering what is the AAVE health factor metric and how it can help you manage your crypto loan? Learn more in this article.

AAVE is a decentralized finance platform where investors can stake crypto and potentially borrow against it.

The AAVE health mark factor is a number determining a borrower’s loan-to-value ratio. It basically indicates their chances of getting liquidated on a crypto loan. Borrowers should keep it above 1.0 to avoid losing crypto, although keep this number much higher to play it safe. AAVE defines its health factor as follows:

The health factor is the numeric representation of the safety of your deposited assets against the borrowed assets and its underlying value. The higher the value is, the safer the state of your funds are against a liquidation scenario.

I’m not a financial advisor and crypto loans are incredibly risky. I published this content for informational purposes only. Always do your own research.

When depositing, borrowing, or withdrawing crypto, AAVE presents the impact of any loan or deposit via its health factor number. This number indicates a borrow’s liquidation threshold (typically 75-80% of collateral, depending on the currency in question).

The health factor number indicates your liquidation threshold or the percentage at which a loan is defined as undercollateralized. If the AAVE health factor drops below one, AAVE automatically repays up to 50% of a borrower’s loan automatically using staked collateral. The smart contract underpinning AAVE also charges a liquidation fee.

You can read up on the AAVE risk parameters underpinning a loan-to-value ratio on its documentation site.

Maintaining a Safe AAVE Health Factor

If you’re depositing or borrowing using AAVE, bridge assets across to Avalanche or Polygon rather than Ethereum Mainnet unless you enjoy expensive gas fees. You can bridge using a link on the AAVE dashboard, and it takes 5-10 minutes.

You’ll still need to pay gas to bridge, so factor that into borrowing costs. However, a loan becomes much cheaper to manage once on Polygon or Avalanche. Borrowers pay interest on any loan, but they can also earn rewards for borrowing and staking crypto too. Remember to secure your AAVE account with a hardware wallet.

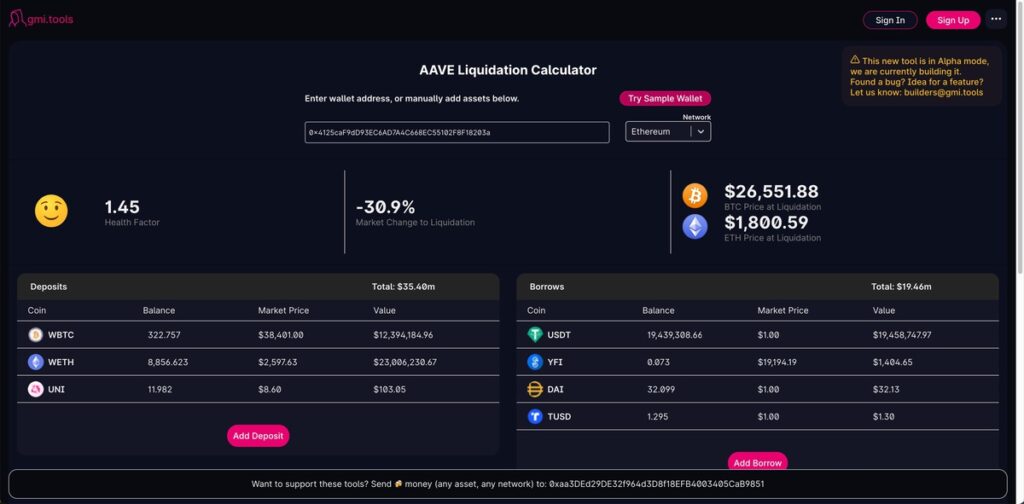

Translating a health factor number into monetary figures is a worthwhile exercise. Some investors track percentages on a spreadsheet. I use GMI.tools (going to make it!), as it’s free and relatively straightforward.

- Paste in your address

- Select the right blockchain

- Play around the different potential liquidation scenarios

- Deposit funds or borrow accordingly

Using this free tool, borrowers can play around with potential changes to their deposits in AAVE without selling or buying crypto. They can see what happens after depositing or withdrawing BTC, ETH or stable coins.

They can also gauge the impact of increasing my loan to stake elsewhere. It is useful for ensuring an AAVE health factor stays above 1.5. It’s also faster than calculating an LTV ratio in a spreadsheet

You can also set up alerts on the AAVE set about drops in a health factor ratio. It’ll send notifications to your email, Discord, Slack or Twitter account when your ratio reaches and or drops below a determined amount. Again, this only takes a few minutes to set up.

If a borrower sees their health factor dropping and wants to avoid liquidation, they have some options for improving this number:

- Deposit more collateral

- Pay off some of the loan

- Deposit stablecoins like USDT, DAI USDC (these are unlikely to drop in price versus crypto)

How I Use AAVE Health Factor Metric

A few months ago, I took out a crypto loan using Bitcoin as collateral, on the Nexo platform. That’s a relatively easy-to-use centralized finance platform with competitive rates.

Then, I investigated decentralized finance web 3.0 platforms like AAVE. The staking and borrowing rates are usually more competitive in DeFi vs CeFi.

So, I migrated over to AAVE. I bridged collateral, in this case, Ethereum and Bitcoin, across to the Avalanche blockchain using AAVE. Then, borrowed some stablecoins to stake elsewhere at a rate exceeding the borrowing rate.

I use Ethereum and Bitcoin as collateral as they’re established cryptocurrencies. I only borrowed stable coins as borrowers must pay off the loan in its original currency. You could borrow Bitcoin and then hope the price drops. But that’s highly risky!

I took me ten minutes to bridge my assets, but it can take longer depending on the congestion of the blockchain. A few months ago, that nearly caught me out. At the time, I maintained a riskier AAVE health factor ratio. When BTC dropped in price suddenly, I had to bridge collateral assets over quickly from Ethereum mainnet to Polygon.

These days, I’m more conservative with my health factor metric. After asking other investors, they suggested this rule of thumb: borrow no more than 33% against deposited collateral.

That rule of thumb keeps borrowers above 1.5. It’d take time for the market to drop that much, which means borrowers can either bridge more funds across or pay off the loan before the market drops further (in theory).

Although I like AAVE, I regularly check its crypto loan and staking rates alongside reviewing my health factor metric. These rates change on a daily basis. Use a site like DeFi Rate to do this. You can view rates over the past 30 days and compare AAVE to other platforms like Nexo and Compound and AAVE.

AAVE is a safer and more established platform for crypto loans and staking. Assuming you do your own research and maintain a good health factor, it’s easy to use.