Fungible vs non-fungible tokens: these terms are often confused. In this article, I’ll explain the differences between both.

When I first heard about non-fungible tokens, I went straight to the dictionary. I wasn’t the only one! NFTs or non-fungible token was the Collins Dictionary Word of the Year for 2021. It defines an NFT as:

A unique digital certificate, registered in a blockchain, that is used to record ownership of an asset such as an artwork or a collectible

Clear? Perhaps. Perhaps not. Before 2021, the terms fungible and non-fungible weren’t used much in everyday conversations or online.

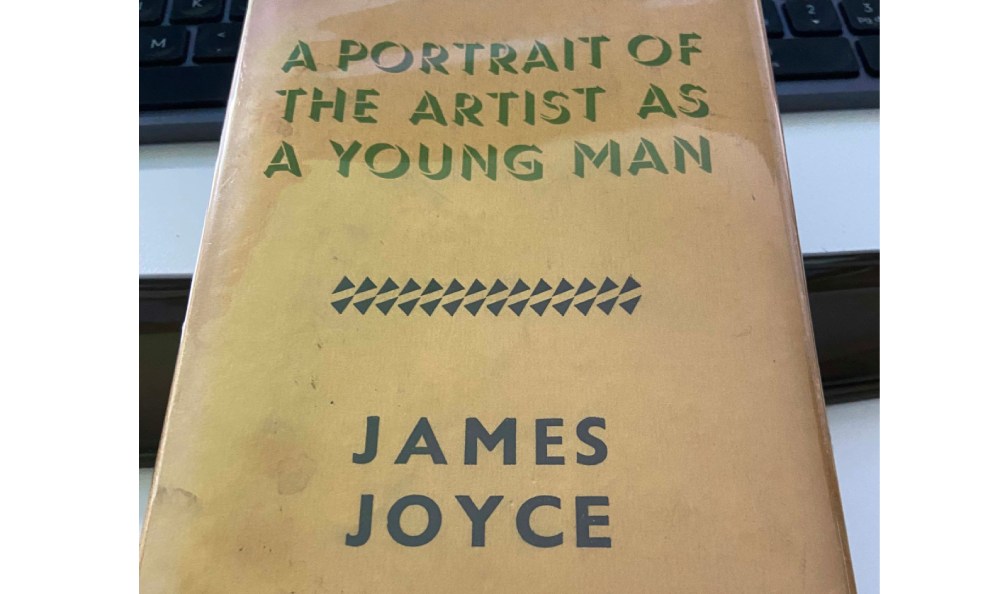

I wanted to figure out what exactly is a non-fungible token, how it’s different to fungible tokens, and the best examples of both. My search beyond a basic dictionary definition led me to reading up on smart contracts, buying a few NFTs, and acquiring a rare book by James Joyce.

Table of Contents

Examples of Fungible Goods

Fungible describes a good or asset that is divisible, replaceable, and easily interchangeable.

We use these types of goods as a store of value or to buy goods and services. FIAT currency or traditional currency like the Euro or dollar is the most common example.

If you and I each have $50 bills, we can swap them, without noticeable differences between bills. We can also use our money to buy the same quantity of goods and services. In other words, our money is interchangeable and replaceable.

Similarly, let’s say you go into your local post office or shop and buy a booklet of a dozen stamps. It’s an easily replaceable real-world purchase that’s worth the same amount in every shop or post office.

Stocks and shares are also fungible. I can buy shares in Apple and sell them. I may make a loss or a profit but each share is identical.

If you go on to the Nike website and buy a pair of trainers, they’re fungible too, no matter the price or branding. You may love your new trainers, but you can return them and get an identical pair easily.

Gold is another popular example of a fungible asset. An ounce of gold sold in the United States holds a similar price to an ounce bought in the United Kingdom. You can also trade a bar of gold or part thereof, relatively easily.

Most cryptocurrencies and tokens are fungible, even though they only exist online.

Bitcoin is a type of digital gold. You can exchange one Bitcoin for another Bitcoin, and both hold the same monetary value. It’s kind of like digital gold.

If you bought a Bitcoin several years ago, you might feel sentimental about holding a Bitcoin, but blockchain technology doesn’t care for emotion. So your Bitcoin is replaceable.

Bitcoin is divisible too. You can break one down into smaller units or Satoshi and spend or give these away, without receivers noticing the difference.

Ethereum works in a similar fashion. It’s built using the ERC-20 standard, that is Ethereum Request for Comment. This standard provides a set of rules which Ethereum-based tokens must follow if someone wants to use, build on, send or receive them.

Thanks to this standard, anyone can exchange or replace one ETH for another ETH without affecting the value of their holdings.

In summary, today, examples of fungible goods and tokens include:

- Real-world currencies

- Stocks and shares

- Cryptocurrencies like Bitcoin and Litecoin

- Divisible assets like gold

- Most consumer goods e.g. trainers

- ERC-20 tokens e.g. Ethereum

Examples of Non-Fungible Assets

Non-fungible goods or tokens are unique, indivisible, and irreplaceable. They are usually a form of intellectual property too.

When we talk about an idea or a cultural artifact moment, that’s non-fungible like Trump’s Red Hat or Obama’s “Yes we can!” slogan.

One day, you discover your grandfather’s rare stamp collection in the attic. Chances are the rare ones are near impossible to acquire and no one is creating any more of them. You can’t tear up the stamp and give half to a jealous sibling. If you lose a stamp from the collection, you can’t easily replace it with another, either. In this case, his rare stamps are non-fungible.

Rare stamps trade hands for six and seven figures for this reason. The world’s rarest stamp, the British Guiana One-Cent Magenta, sold for $8.3 in New York, in 2021.

Real-world trading cards and comic book covers serve as other examples of non-fungible goods. It cost only 10cents to buy the first Superman comic book in 1938. Good luck buying that comic book today. In 2014, a first edition Superman comic book cover sold for $3.2 million.

While you can easily trade one ounce of gold for another, a gold wedding ring is non-fungible. It holds sentimental value for the owner and, if they lose it, it’s impossible to replace. Sure they can buy another gold wedding ring, but it’s not their wedding ring.

Anyone can buy Kanye West designed trainers on a sports goods store for a couple of hundred dollars, but the specific trainers Kanye West wore to the 2008 Grammy are non-fungible. They sold for $1.8 million to a collector.

To me and many others, that sounds crazy money to spend on smelly celeb clothing. But these black leather Yeezy prototypes are worth $1.8 million due because Kanye wore them and collectors perceive value in their cultural association to him. Buyer of goods like these also can’t easily replace their collectibles or break them up and expect a similar outcome.

Non-fungible tokens hold value because of their place in history or status as a cultural artifact. If you visit the Louvre Museum in Paris with a friend and take a picture of the Mona Lisa, you can send digital files and photos to each other. But these pictures are worthless (except to you and your friend). However, the Mona Lisa painting itself is unique, irreplaceable, and therefore priceless

In summary, examples of non-fungible tokens and goods include:

- Artwork

- Intellectual property

- Games

- Music

- Rare books

- Rare collectibles e.g. stamps, comic book coves

- ER-721 tokens e.g. what you can find on NFT marketplaces like OpenSea

Digital NFTs

Digital assets sold on OpenSea, Rarible, and other NFT marketplaces are the latest examples of non-fungible goods and tokens.

LarvaLabs released the first NFT using Ethereum blockchain technology in 2018. Only 10,0000 exists in this collection, and they inspired other successful projects like the CryptoKitties.

You could have minted one from this limited collection for free. But if you lost your CryptoPunk or sold it, you can’t replace one CryptoPunk with another identical version that lives on the blockchain.

The CryptoPunks project served as inspiration for the ER-721 standard, which powers many current NFT projects and decentralised finance applications. Essentially, this standard demonstrates why a token is unique and proof of ownership.

Similarly, anyone can look Beeple’s Everydays: The First 5000 Days, worth $69 million, save it to their desktop. But digital art collectors regard that as akin to snapping the Mona Lisa with a smartphone. By all means enjoy Mike Winkelmann’s work for free, much like a visitor to the Louvre museum

Digital artists use code to create too, like Chromie Squiggle and The Eternal Pump. Thanks to the underlying technology, each piece is verifiably unique and traceable. Owners can also sell on these art pieces, while the original creator receives a percentage of secondary sales.

Learn more about why NFTs are so expensive.

Fungible Vs Non-Fungible Tokens: The Final Word

Earlier in 2021, I visited a rare bookshop in Dublin City Center. On a whim, I bought a 1944 edition of A Portrait of the Artist as a Young Man by Irish author James Joyce. I spent approximately €200 on the book. In this case, the book is akin to a non-fungible collectible.

While I can buy A Portrait of the Artist as a Young Man on Kindle or even download a digital file for free, it’s not the same as owning a rare print copy. I also can’t easily buy another copy from the same print run either, at least according to the store owner!

Around the same time, I bought my first NFT. I expect some of my subsequent NFT purchases to go to zero, but I bought them because I wanted to collect several to learn more about the space.

Whether someone sees value in buying JPEGs, GIFs, memes, or even rare books, doesn’t change the fact that a few bluechip NFTS or other collectibles hold value for collectors. And a few are fun to buy and keep, much like a rare stamp, comic book, or book.

The language and terminology around NFTs and digital assets take time to unpick. Learning the differences between fungible and non-fungible tokens and exploring how blockchain technology operates can help would-be NFT collectors navigate the space more easily.

Like this? Learn more about the future of NFTs.